social security tax netherlands

Under the national insurance tax regulations contributions are levied on income up to a maximum of EUR 35472. The tax rates and tax credits pursuant to the proposals in the 2022 Tax Plan reveal the rate of the first.

Social Security Tax Netherlands Support For Employers Employees

Social Security Rate in Netherlands averaged 4994 percent from 2000 until 2021 reaching an all time high of 5305.

. If you reside in the. If you are self-employed and would normally have to pay social security taxes to both the us. The maximum rate was 5305 and minimum was 4612.

Currently first half of 2022 the social security withholding for EU residents permanently working in the Netherlands is 2765. Social Security Rate in Netherlands increased to 5124 in 2021. At present the contribution is capped at EUR 9808 per annum.

The Tax tables below include the. Any Dutch payroll tax already withheld on the income will reduce the amount of Dutch personal income tax payable. The work-related costs scheme allows employers to provide some benefits tax free such as travel allowances study costs lunches and Christmas hampers.

If you are not established in the Netherlands but you employ poeple who live or work in the Netherlands you may have to withhold payroll taxes. In that case you must register as an. It covers contributions for old-age social.

If you are not insured in the Netherlands but in the country where you were transfered from based on a A1 declaration or Certificate of Coverage then you dont pay. Data published Yearly by Tax and Customs. This is just pure salary and is the amount your payroll tax and social security contribution costs are based on.

The Social Security Rate in Netherlands stands at 5124 percent. The employer-paid social security contributions for 2021 set in the regulation are as follows. If you are self-employed and reside in the United States or the.

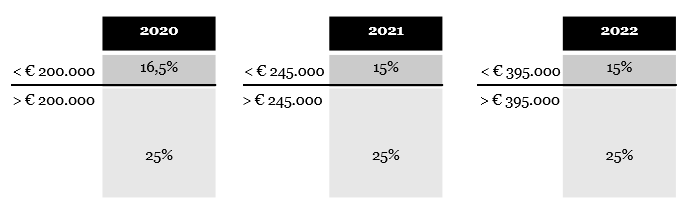

With this ruling the employer is able to grant a tax-free allowance consisting of maximum 30 of the taxable salary in the Netherlands. The proposals generally are intended to be effective 1 January 2022. If you are covered under the Dutch system you and your employer if you are an employee must pay Dutch social security taxes.

Social insurances can be subdivided into national insurances and employee insurances. The contribution is 2815 percent of your salary but will never exceed about 9400 euros. The Income tax rates and personal allowances in the Netherlands are updated annually with new tax tables published for Resident and Non-resident taxpayers.

And dutch systems you can establish your exemption from one of the taxes. The Dutch social security contribution is levied together with income tax. The income an individual receives is subject to Dutch personal income tax.

The social security system in the Netherlands consists of social services and social insurances. Holiday allowance vakantiegeld Employees in the Netherlands accrue. Employers may provide such items.

General unemployment insurance AWF 270 for contracted workers with an.

The 12 Countries Where Poor Children Are More Likely To Get Rich And Actually Achieve The American Dream Than In The Us How To Get Rich Country Country Studies

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

Payroll Tax Netherlands Safeguard Global

Total Tax Revenue Us Taxes Are Low Relative To Those In Other Developed Countries In 2014 Us Taxes At A Gross Domestic Product Developing Country Social Data

I Am 100 Va Disabled Why Did Social Security Disability Deny Me In 2022 Social Security Disability Social Security Disability

/heroexportjourney-4229705-df42b41ba8f7483fba08a542a4eae4ac.jpg)

Social Security Tax Definition

Social Security In The Netherlands Zorgverzekering Informatie Centrum

Impuesto Al Trabajo 2018 Ocde Income Tax Plus Employee And Employer Social Security Contributions As Of Labour Costs 2017 Income Tax Payroll Taxes Wage

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp

Tax Returns 2019 Irs Most Likely To Audit Taxpayers In These Regions Cbs News Http Back Ly Zgtaz Regions Audit Irs Tax Money Business Rules

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Sources Of Us Tax Revenue By Tax Type 2022 Tax Foundation

What Small Business Owners Should Know About Social Security Taxes

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

When Is Disney Coming To My Country Disney Go Disney Plus Disney App

Https Twitter Com Oecdtax Status 851729635641524224 Belgium Germany Employment Germany